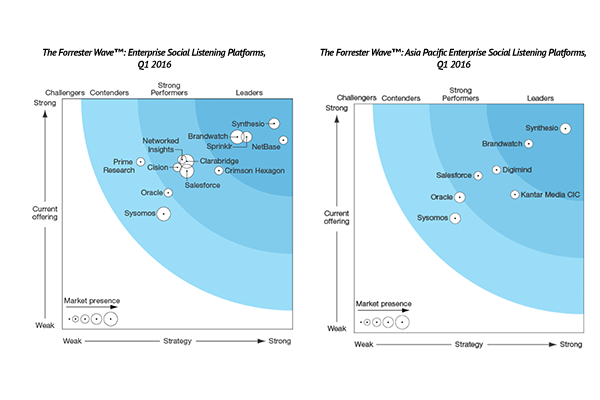

Last week, Forrester released its latest report on Enterprise Social Listening Platforms. The report showed Synthesio clearly in the lead, with Brandwatch, Sprinklr and Netbase all defined as leaders. Reflecting the increased integration of digital within the enterprise, the report highlighted that “social listening platforms prove their value beyond simple brand monitoring by doubling down on analytics and surfacing insights that can be used across the enterprise.”

The focus on the enterprise was reflected in Synthesio’s response to the report, with Leah Pope highlighting that the company “was cited for a “strategic vision and roadmap focused on the potential of social listening and on metrics that tie to business results”…. “[S]ynthesio’s ability to align social listening data with a firm’s other business data enables its clients to quickly mature their listening programs. This is achieved primarily through the strong ecosystem of partnerships Synthesio has built with vendors, as well as an extensive API that supports merging all forms of business data.””

Customer partnership was a theme echoed by Giles Palmer, Brandwatch’s CEO. Palmer stated “Unlocking the value of social intelligence is important for our customers, and our customers are the top priority at Brandwatch. The Forrester report notes, ‘Customer references expressed Brandwatch’s commitment to being a strategic partner’ — because that is precisely what we are striving to do. We want to help our customers glean the most relevant and actionable insights from social data to make smarter business decisions every day.”

For the first time, Forrester has added an APAC wave. The difficulties in Asian language analysis and securing content has resulted in the APAC region being avoided by the major US and European players for some time. Of the nine leaders or strong contenders in the global Wave only three remain in the APAC wave – Synthesio, Brandwatch and Salesforce. APAC represents a significant opportunity for growth for all major players. The region hosts mature and socially-active consumer markets and the most exciting social media environment, China.

The latest results are below:

Changes from 2014 and 2012

While Synthesio retained it’s 2014 lead, there were some position changes. Both Brandwatch and Netbase have shifted up from being Strong Performers. Brandwatch, in particular, has seen a significant increase in the size of its business. Newcomers included Prime Research and Clarabridge. The latter provides the text mining software that helps to power some of the other social listening platforms, so it’ll be interesting to see how it’s performance is reflected with its partners in future studies.

After being seen as a Leader in both 2012 and 2014, Cision dropped down to Strong Performer. (Visible Technologies was acquired by Cision in 2014.) Of course, being a Strong Performer is not always bad – Salesforce’s dropped from Leader to Strong Performer in 2014, where it still remains and the platform has been boosted by Salesforce’s incredibly positive brand appeal. Whether Cision can match that level of goodwill in the social listening space remains to be seen.

The Forrester Wave report provides an understanding of the current state of the industry, but digital teams choosing a platform will need to reflect on their organisation’s unique needs. While there is an appeal to simply choosing the leader, each platform offers it’s own benefits. Of course, finding a tool that can surface insights to be used across the enterprise should probably be top of the list.