In this guest post, Commetric’s Sarah Curnow outlines the key findings from recent research comparing Twitter analysis with survey data.

Brand marketers have long used surveys to question consumers on their opinions. Now, via fast-growing social media channels, consumers are volunteering these opinions, unedited and in real-time. Can this rich source of content be mined to complement, guide or even replace the traditional survey?

Commetric and strategic research consultancy Incite pooled resources to test this and look for correlations and contradictions. We surveyed 2,000 people for their opinions on five major high street ‘casual dining’ brands and compared responses with an analysis of three months’ Twitter discussion of the same brands.

We found that comparing social and survey data gives us more confidence in the accuracy of both techniques – and that it can give a useful guide to what is driving social conversation. Crucially, it also shows compelling correlations between measures of positive sentiment in each data set. While the study suggests that simple Twitter ‘snapshot’ analysis cannot totally replace the traditional survey, it has opened up further interesting lines of enquiry.

Brand equity measures are possible with social media

The number of people indicating that a brand was a favourite in survey data closely correlates with the balance of positive/negative sentiment about that brand in social media. In fact, the study showed a correlation of 83 per cent, with the most favourably discussed brands on Twitter correlating with the stated favourites from the survey. The research suggest that that brand preference could be roughly determined quickly and cost-effectively using social media analysis, with a fair degree of confidence.

Time and intent makes it harder to predict customer satisfaction using Twitter

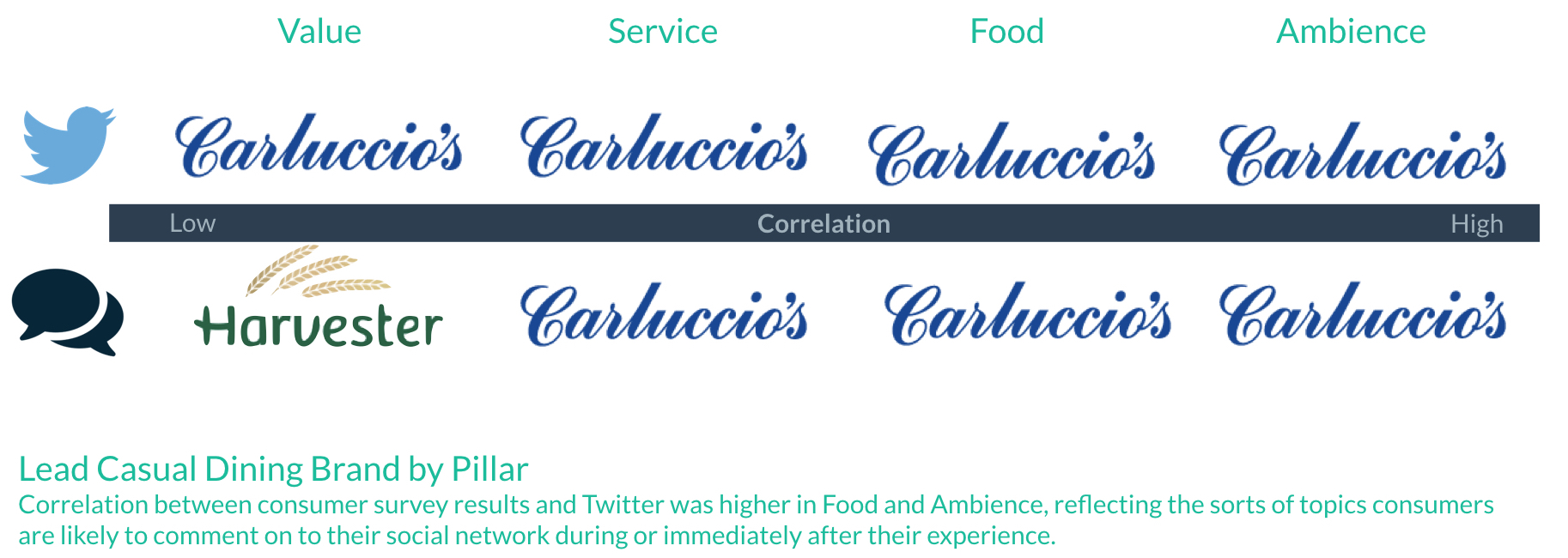

The study suggests that if people are generally loyal to a high street dining brand, survey responses about their relatively recent experience of the brand (i.e. not immediately after consumption) are more likely to reflect their overall opinion of the brand. This is perhaps because the survey process encourages a more reflective, formal response or because a ‘one-off’ experience has simply faded. However, tweets are informal and tend to describe people’s feelings during or immediately after the most recent experience, with consumers posting at the venue or very shortly after. This difference between the psyche of the individual at the time – and in the context of the response – makes it harder to use a snapshot measure of social media opinion to predict overall customer satisfaction, at least as it is traditionally measured.

Use social data to pre-empt and support consumer research

As consumers are more likely to tweet about brands they love, and experiences they hate, then this study suggests social media could be used as a ‘canary’ in the mine, a warning of trouble to come, or of opportunities to exploit. Immediate analysis of conversations about experience and products could be valuable in helping marketers improve service – and tweak survey designs.

At the aggregated level too, the very promising correlations between survey and Twitter data suggest that there is no doubt that social media studies can, at times, be surrogates for formal consumer research and both types of data can support each other. More work needs to be done, especially in looking at longer-term social media trends and understanding how the sub-elements of the ‘pillars’ which underlie the satisfaction model in the survey design could be replicated, but it is a very interesting start.

Contact Commetric to discuss the ‘Social v Survey’ study with us.

About Sarah Curnow

Sarah has over 15 years of global account experience with Fortune 500 brands. Formerly with Accenture, Sarah moved to head business intelligence at Hill & Knowlton where she worked with other WPP companies such as Kantar Media and Mindshare. She then founded her own research company, working for the UK’s Foreign and Commonwealth Office, the British Council and providing an outsourced research solution for Dow Jones. Sarah has spoken at conferences including “PR and the New Media”, PR Week’s “Taking the Drama Out of a Crisis” and “Knowledge Management in a Creative Environment” and provided media evaluation training at the Chartered Institute of Marketing. Connect with Sarah on LinkedIn.